The Entrepreneur's Guide to Cash Flow

Part Four: Why is a cash forecast important, and how do we forecast it?

Have you ever woken up in a cold sweat wondering if you had enough money in the bank to pay for your inventory and pay those quarterly taxes while still having enough left over to make payroll?

It’s a terrifying place to be, and if you’re ready to not be quite so scared, you better have a 13-week cash flow forecast in place.

Keep it Simple Stupid

Forecasting—especially in the age of AI—often seems mystical. It’s as if you need to be an oracle on a mountaintop reading chicken entrails to predict next Tuesday's sales.

In reality, all you need is a spreadsheet and to dedicate some time to plan. You can always make it fancier later. The important thing is to draft a plan and execute against it.

The Secret CFO (a newsletter superior to my own) offers an excellent, straightforward crash course on forecasting that's worth your time.

I'll share my perspective later. For now, here's a simple template to get you started.

Why do I Love this Tool?

Whenever I engage a new Fractional CFO client, I always start with this 13-Week Cash Flow forecast. If necessary, I spend my first two weeks just standing this up. Why?

It's Simple to Implement

Filling the template out is no more complicated than a three-month version of your own household budget. How much are you going to get paid? How much will you need to pay to someone else?

That's it. With a little time and elbow grease, you'll have something workable—if you follow the detailed steps that I’ll lay out later, you can create a draft in about forty-five minutes.

Now, as your business grows, it is worthwhile investing in more sophisticated forecasting methods. These can range from out-of-the-box solutions to simple Excel-based tools that pack a surprisingly powerful punch and are much more accurate than the back of your napkin.

For now, let’s not let perfect be the enemy of good enough.

It’s a Powerful, Tactical Decision Making Tool

This forecast serves as a control mechanism to ensure wise cash management while helping you identify problems and take decisive actions to address them. Say goodbye to those sleepless nights wondering about making payroll. Instead, you'll anticipate cash flow challenges and eliminate them through confident decision-making.

Why 13 weeks specifically? It's short enough that you can predict with reasonable confidence and accuracy—and the more you use it, the more precise your forecasts become.

It's also long enough that significant tactical decisions made today will materialize within the forecast's timeframe. If the tool shows you're running out of cash in 10 weeks, you'd better start working on solutions immediately (whether that's securing a line of credit or making tough decisions about staffing).

It’s a platform for further transformation

After building a customized forecast with clients, we layer in automations and tools for greater accuracy. When needed, I implement predictive algorithms for cash receipts and set up the ERP to automatically refresh actuals weekly.

Once I'm confident in the short-term picture and how to influence it, I shift focus to longer-term strategy—like building a cash reserve to ensure we can meet payroll 9 months from now, or identifying which vendors we should negotiate with to get better terms and stretch out our accounts payable.

Steps to Setting this up

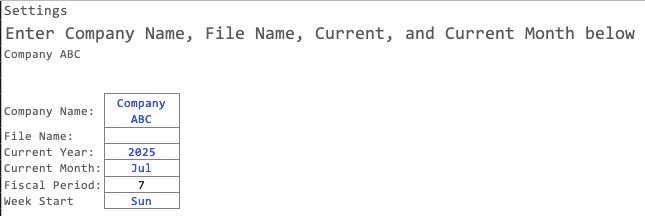

Step One: Enter your Settings

On the Settings tab simply fill in the necessary information:

Company Name

File Name

Current Year

Current Month (dropdown)

Week Start: 1 - Sunday, 2 - Monday, etc

.

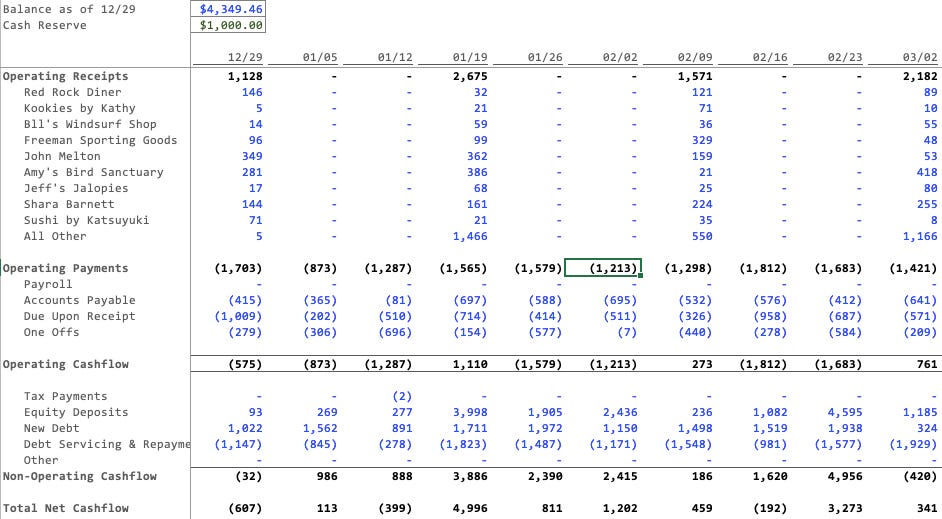

Next, on the Forecast tab, enter the forecast start date (defaults to today), your business's cash balance at the start of the forecast week, and your Cash Reserve.

The Cash Reserve is your minimum cash balance that provides peace of mind—a target you never want to hit.

Why have it? It creates a buffer that's better than zero. The amount varies person to person, but I generally tie it to one of these:

enough to pay off all debt in a doomsday scenario (e.g., $10,000 to clear your line of credit)

3-6 months of expenses (e.g., $10,000 monthly expenses × 3 months = $30,000)

The first option lets you close shop cleanly if absolutely necessary. The second buys you 3-6 months during a downturn.

Either way, it establishes your "safe" minimum before hitting absolute zero. It’s the amount that allows you to exhale and say “I at least have enough cash to weather the next three months.”

When customers pay you late or the economy takes a dump on you, believe me, you’ll be glad that you have that buffer in place.

Step Two: Fill out Actuals

Now fill out your Actuals. Ideally, use the statement of cash flows from your bookkeeping service. If your bookkeeper can't help with this, it's time to get serious and sign up for QuickBooks or similar software.

As a last resort, use your business bank account(s). Take the most recent month and categorize each cash transaction individually.

This exercise alone will reveal more about your business than you might be comfortable knowing.

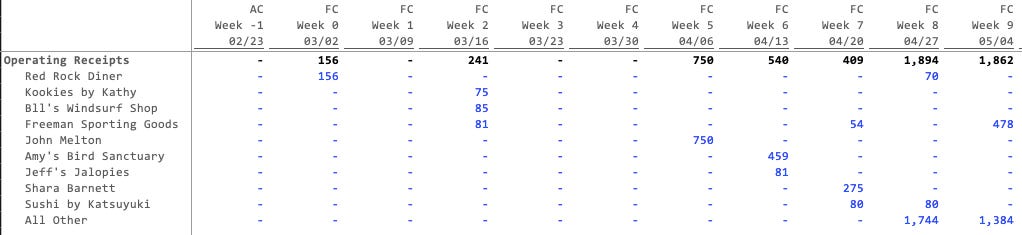

Step Three: Fill out Forecast

Plan Receipts

Next, plan out the payments you expect from customers over the next 13 weeks. For B2B businesses, this is typically straightforward. Look at what you've already billed that will be collected in the coming month, then estimate your billings for the following two months and project collections accordingly.

If that's not feasible, or if you're in a B2C industry like Retail, leverage a trailing 13-week cash flow statement instead.

Running QuickBooks Online? That report is already right at your fingertips—assuming your bookkeeping is clean.

You can even just look at your last few weeks of direct sales, calculate an average, and apply it going forward. These forecasts then become weekly targets for you to hit.

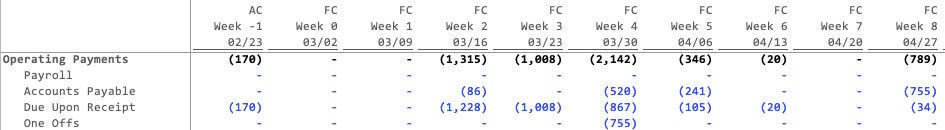

Plan Payments

Next, plan out your expenses for the next 13 weeks. The first month is straightforward—just use the invoices already in hand. Beyond that, identify your recurring expenses first, then add in your non-recurring costs.

This non-recurring (One Offs) bucket is crucial—it's a key lever for controlling cash burn. For instance, if a large inventory purchase next week would drop you below your minimum cash threshold, consider buying when you have a surplus or spreading purchases over time.

Still struggling to map out these outflows? An aging Accounts Payable Report can help (assuming your books are in order).

Plan One-Time Cash Draws or Cash Infusions

Finally, capture any one-time cash flows that fall outside normal operations. These could be either inflows or outflows.

For example, mark your tax estimates for upcoming installment weeks, or include any debt service payments you need to make.

If you anticipate needing to inject cash into the business, include these under the Equity Deposits and New Debt lines.

Step Four: Copy to the Prior Forecast tab and Review

Once you've completed your forecast, copy and paste (values only) to the prior forecast tab, then wait for the week to end.

First thing Monday morning, update the actuals tab and head to the review tab.

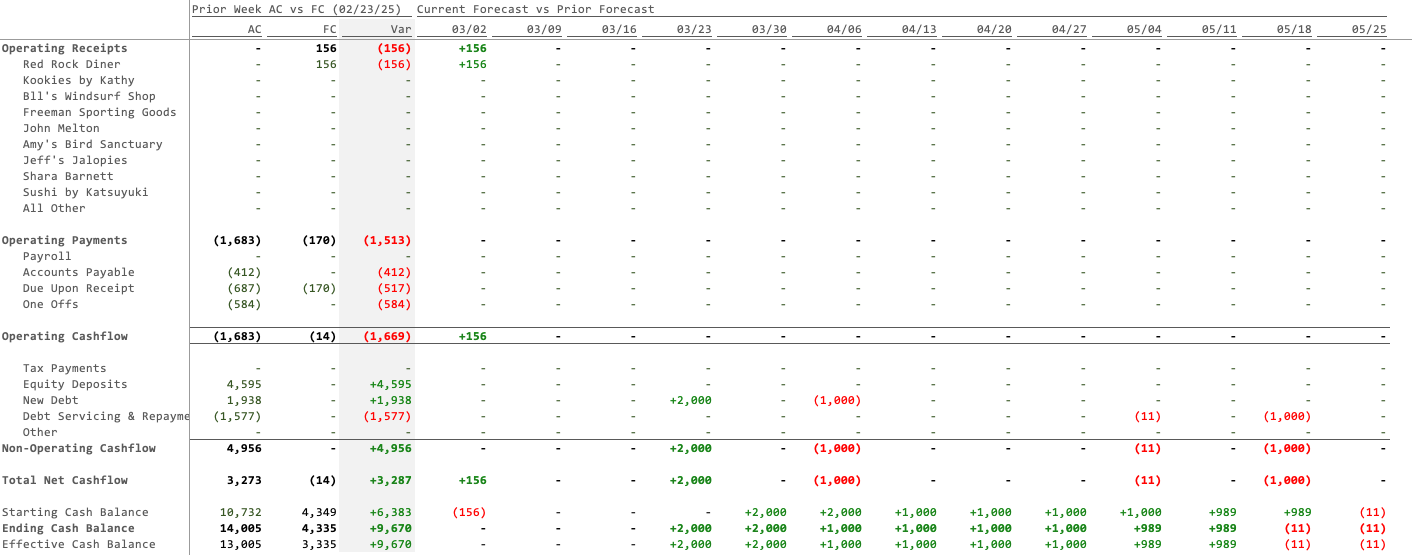

You'll immediately see variances across two key comparisons:

The Prior Week's actuals vs the Forecast

The Current Forecast vs the Prior Forecast for go-forward weeks

What do we see?

Red Rock Diner didn’t pay me last week as expected even though their invoice was due. I better get on their add the week of 3/2 because I’m owed that money

I saw a cash crunch coming at the end of march, I should draw on the line of credit for $2,000 the last full week of the month

With that new debt, I’ll have a new payment starting 5/1

Things are looking better in May, let’s pay down the debt with some of our excess cash

When examining the prior week's variance, you need to understand exactly where and why you were off. After identifying these discrepancies, adjust your forecast accordingly, allowing you to compare your new forecast against the prior one.

This exercise will hit you square in the face with necessary actions to influence your business's cash flow.

By Tuesday, you should have an updated forecast (repeat step three) that you'll manage toward until refreshing again the following Monday.

First Steps into a Larger World

That’s it, now rinse and repeat. The first 2-3 weeks this will likely feel like a chore, but if you commit yourself to it, you’ll reap a ton of rewards least of which is a few more hours of restful sleep.

In our next installment, we’ll discuss timing strategies for payments and collections, and how to make informed decisions that prioritize long-term cash generation.

Work with me: build your 13‑week cash flow forecast

If you are still worried about white‑knuckling your cash, I’ve helped entrepreneurs and small business owners stand up a simple, tactical 13‑week cash forecast that reduces surprises and unlocks confident decisions.

Here’s what we’ll do together:

Quick assessment of your current cash picture and tools

Stand up a tailored 13‑week forecast you can run every Monday

Identify the 2–3 moves that improve cash the fastest

Ready to get relief and clarity?

Or email me directly at greg@ggernetzke.com

If you’re a fractional CFO, I’m also happy to collaborate on a streamlined setup you can roll out across clients with automated tools that allow you to focus on action rather than plugging and chugging through data.