The Entrepreneur's Guide to Cash Flow

Part Three: How to Read a Cash Flow Statement

In our previous installments, we established why cash is king and what a cash flow statement is. Now let's get practical and learn how to read one of these critical documents.

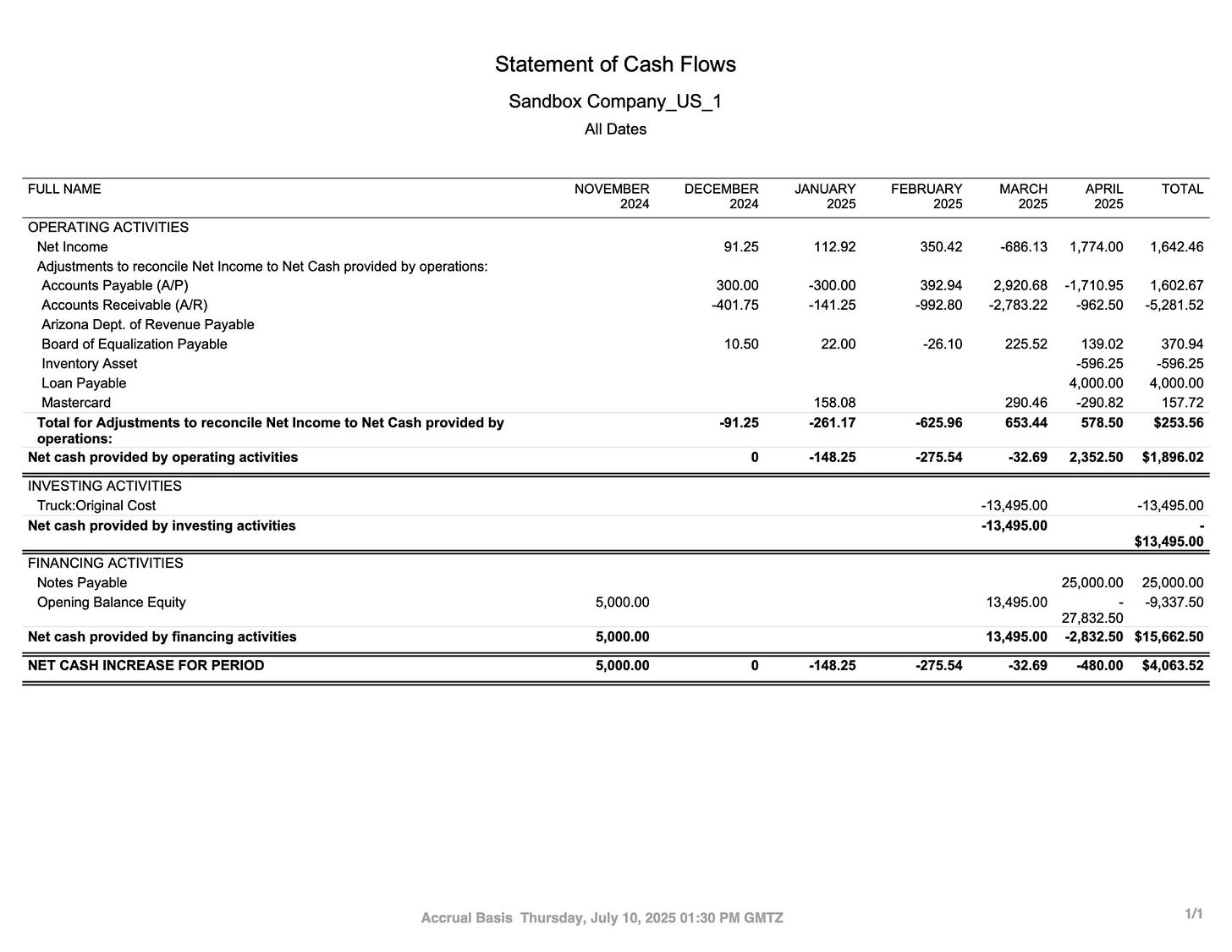

Below is an example cash flow statement that I pulled from the QuickBooks sandbox. It's a made up landscaping company that I lovingly refer to as "Mow Money Mow Problems."

Start at the Bottom

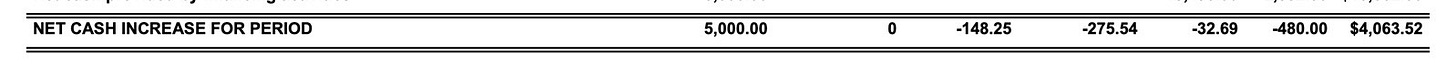

First let's look at the bottom line. What does it tell us? It tells us how much cash flowed in (or out) in that month. Simple enough.

In customer cash flow reporting I also like to layer in the beginning and ending balance of cash so we can see how the net cash increase for a period actually materializes in the cash balance (i.e. the bank account).

This bottom-line view is your financial vital sign. If your ending cash balance is consistently decreasing month over month, you've got a problem that needs addressing – regardless of what your P&L might say.

Where Did It Come From and Where Did It Go?

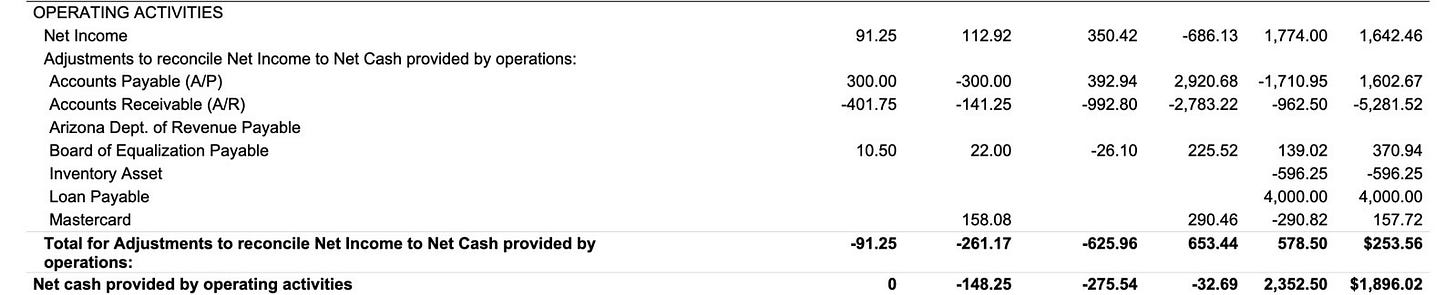

Next, we can see how much cash flowed in (or out) by three broad categories:

1. Operations

This is by far the most important area. Think of this as the cash equivalent of your profitability. It reflects the actual amount of cash flowing into your business from revenue generating activities (sales, collections, etc.), and how much cash is flowing out of your business from your expenses (vendor payments, payroll, etc.).

There is nowhere to hide in this section. If customers are behind on paying you, this is where you'll feel it. I cannot tell you how many times I've worked with clients who say something like "I'm profitable, but there is never enough money in the bank." If you have ever had this thought, it's a telltale sign that you are not paying enough attention to your operating cash flow.

Some key items to look for in the operations section:

How much of your net income is actually converting to cash?

Are your accounts receivable growing faster than your revenue? (That's bad – it means customers are taking longer to pay)

Are you building up too much inventory that isn't moving? (Also bad – that's cash sitting on shelves)

Is there a seasonal pattern to your operational cash flow that you need to plan for?

2. Investing

This is where we measure how much cash is being generated (or paid out) to build future operating opportunities. Mow Money Mow Problems bought a truck so it could serve more clients. This is an investment for their operations.

If there is a crew running that truck, that is additional revenue that can be earned that isn't being earned today.

Similarly, the cash paid to build a new store location, acquisition of another company, or even computer equipment is considered an investment activity. All of these things go toward enabling future operations.

Any activity that requires you to pony up cash (i.e. the car purchase) is reflected as a negative number. Any activity that pays you in this category (i.e. dividend payments from stocks in the company's name) is reflected as a positive number.

Smart questions to ask about your investing cash flow:

Are these investments actually going to generate a return that exceeds their cost?

Is the timing right, or should we delay some capital expenditures until our operating cash flow improves?

Are we neglecting critical investments that will hurt us in the long run?

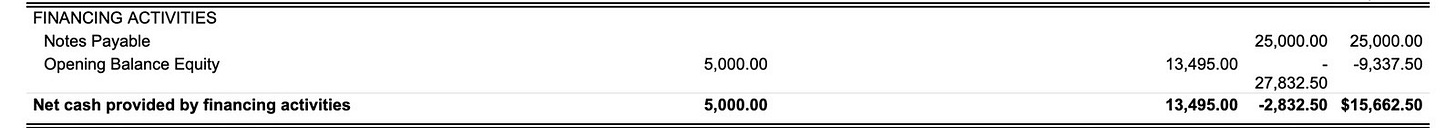

3. Financing

For our purposes consider financing roughly equivalent to "fundraising." This typically comes in two forms:

Debt: cash you get today and you pay back over time

Equity: cash you get today in exchange for a share of the profits later (ownership)

Any activity that brings in cash is reflected as a positive number (i.e. debt principal amounts). Any activity that pays out (i.e. debt repayment) cash is reflected as a negative number.

Key financing considerations:

Is your business relying too heavily on debt to fund operations? (This is usually unsustainable)

Are you in a position to pay down debt, or should you preserve cash for operations?

If you're taking on investors, what expectations do they have for returns, and how will this affect your cash strategy?

What Constitutes "Good"?

Most of this is dependent on exactly what you're trying to do with your business. If you're trying to grow operations, you may be more aggressive with your Investing Cash Flow.

If you're staring down the barrel of a cash shortfall, you may need to focus your efforts on financing.

In addition, there are a few key ratios that I use to help me judge the buckets:

Operating Cash Flow Ratio: OCF ÷ Current Liabilities. This tells you how well your operations can cover your short-term obligations. A ratio above 1.0 means you're generating enough operational cash to cover immediate debts.

Cash Flow to Debt Ratio: OCF ÷ Total Debt. This indicates your ability to repay both short and long-term debt from operations. Higher is better, with anything above 0.20 considered decent for most businesses.

Free Cash Flow: OCF - Capital Expenditures. This tells you how much discretionary cash you have after funding necessary investments to maintain your current operations.

Spotting Red Flags

Your cash flow statement can reveal several warning signs that demand immediate attention:

Consistent Negative Operating Cash Flow: If your core business operations aren't generating positive cash flow over time, your business model might be fundamentally flawed.

Growing Gap Between Net Income and Operating Cash Flow: If profits look good but cash from operations is poor, investigate why. Often this means customers aren't paying, or you're building up too much inventory.

Heavy Reliance on Financing: If you constantly need debt or equity to fund operations, you're not sustainable.

Insufficient Investment: Sometimes the problem isn't spending too much, but spending too little on critical infrastructure, technology, or equipment.

Putting It All Together

A healthy business typically shows a pattern of:

Consistently positive operating cash flow

Strategic investing cash outflows that are proportional to the business's growth plans

Prudent use of financing that doesn't create an unsustainable debt burden

A growing (or at least stable) ending cash balance that provides sufficient cushion for contingencies

Now that we know how to read a cash flow statement, next we'll explore cash flow forecasting techniques that will keep you on top of your bank balance without sucking up all of your time.

Don't forget – the cash flow statement is telling you a story about your business. Take the time to understand what it's saying, and you'll make better decisions that keep your business not just surviving, but thriving.