The Entrepreneur's Guide to Cash Flow

What is a Cash Flow Statement?

In last week's post we discussed why cash is important. Today, we're going to talk about how to take good care of it.

Introducing the Statement of Cash Flow

The cash flow statement measures the movement of cash through your business. It tells you how much cash you started and ended with, how much cash came in and went out (the "flow"), and through which channels this movement occurred.

These channels typically fall into three categories:

Operating Activities: Cash generated from your core business operations

Investing Activities: Cash used to create future cash flow through asset purchases or investments

Financing Activities: Cash from raising funds through debt or equity

How is it arrived at?

This tends to be the most difficult thing for people to understand. The P&L measures how much you sold and how much things cost and how much is left over. Easy enough.

The balance sheet tells you what your assets are worth, how much cash you have in the bank (assets), how much you owe to others (liabilities), and what is left over for shareholders (equity).

The cash flow statement measures the movement of cash. In other words, how much cash did you start and end with, how much cash came in and out of the business, and through which channels.

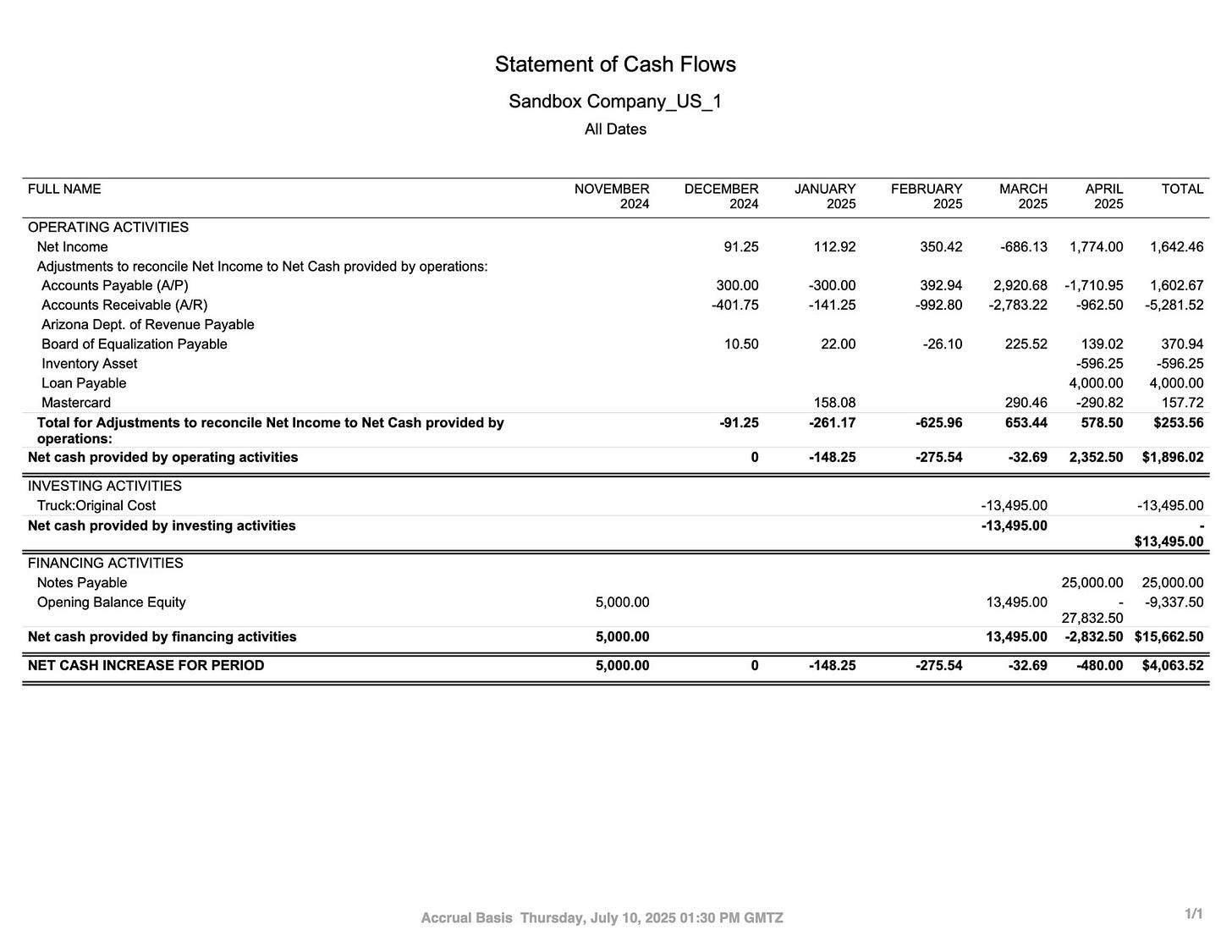

Let's look at an example.

The Indirect Method: How Most Cash Flow Statements Are Built

Most businesses use what's called the "indirect method" for calculating cash flow. This method starts with net income and makes adjustments to convert accrual accounting figures to cash basis.

For example, if accounts receivable increases by $10,000, that means you've recorded $10,000 in sales that you haven't collected in cash yet. So you'd subtract $10,000 from net income to get a more accurate picture of your operating cash flow.

Similarly, if inventory increases by $5,000, that means you spent $5,000 in cash that isn't reflected as an expense on your P&L yet. So you'd subtract that $5,000 from net income as well.

Do you see how cash will not lie to you?

Once you get the hang of it, these adjustments start to make intuitive sense. They're all about answering a simple question: "Did cash actually change hands?"

Always remember that the cash flow measures the movement of cash and its resulting balance. This is a tricky concept to get the hang of, but the more you study it, the more you'll get the hang of it.

Where do you get a statement of cash flow?

Technically, you can build one yourself using nothing but your bank statements, but I wouldn't recommend it. Your bookkeeper ought to have one handy, and if he or she does not, it's time to get a new bookkeeper.

Your bookkeeper also ought to be able to walk you through the cash flow statement. If he or she cannot walk you through it, it's time to get a new bookkeeper. Also, you and I should talk.

If you use any kind of Enterprise Resource Planning (ERP) software like QuickBooks, it will build you one automatically.

Reading Between the Lines

Sit down and examine your cash flow statement thoroughly. If you look at the entries behind it, you will uncover secrets beyond your wildest dreams about your business.

For example, you might discover:

Your business is profitable on paper but hemorrhaging cash due to aggressive growth

You're collecting receivables much slower than you're paying vendors, creating unnecessary cash pressure

Seasonal patterns in your cash flow that you could plan around better

Hidden expenses that aren't properly categorized

The power of the cash flow statement isn't just in the numbers themselves, but in the story they tell about how money moves through your business.

What's Next?

In our next installment, we'll discuss how to read your cash flow statement, how to interpret what it is telling you, and how to leverage it to grow (and protect) your business.

Then in parts four and five, we'll dive into cash flow forecasting techniques and effective cash utilization strategies that will keep you on top of your bank balance without sucking up all of your time.

Until then, I'd encourage you to pull up your most recent cash flow statement and simply familiarize yourself with the major categories and numbers. Which direction is your cash flowing? And more importantly - do you know why?