The Entrepreneur’s Guide to Cash Flow

Part One: Why Cash is King

This post is part one of an on-going series geared towards entrepreneurs who are trying to wrestle their cash flow to the ground.

Whenever I sit down with a new Fractional CFO client, the very first thing I address is cash flow. Of the three financial statements it seems to get the short end of the stick. Everyone wants to know if they are profitable (P&L) and what the business is worth (Balance Sheet).

But everyone ignores the king.

Why is Cash King?

There are three principles that make cash king:

Cash is Oxygen

Cash Does Not Lie

More Cash Means More (and Better) Options

Each of these principles supports the key aspect of your responsibility as a business owner: building a secure cash balance and managing it to maximize long-term cash generation.

More on that a little bit later. For now, let's focus on these laws.

Cash is Oxygen

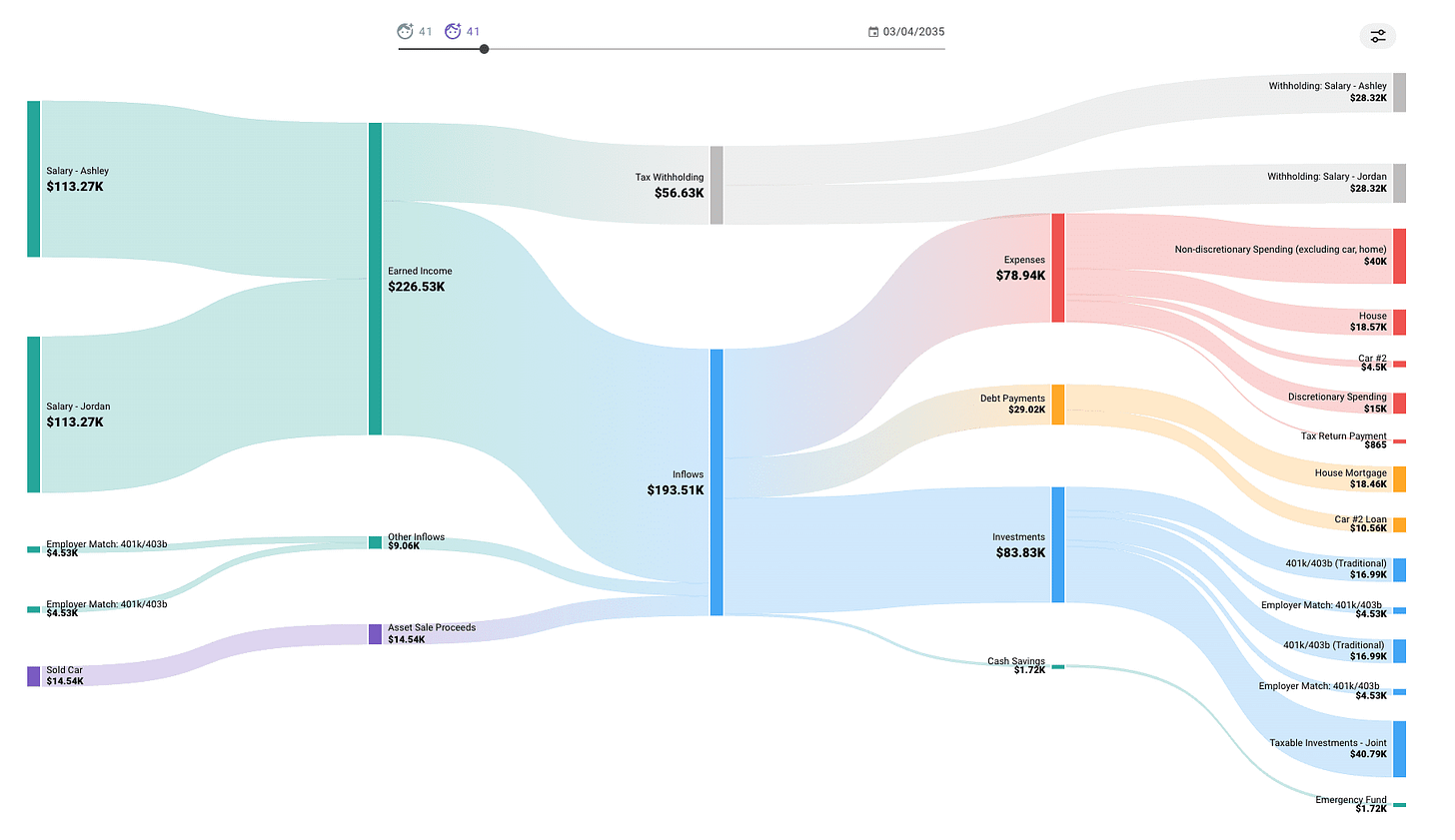

The chart below is called a Sankey Diagram. It represents the movement of cash into and out of a business. Its utility is debatable, but I like it for no other reason that it visualizes the flow of cash and if you think about it, it looks like a cardiovascular system.

Cash flows into the business from left to right, settling in the "chest of the business" before flowing out to various operational areas.

Without cash (and a nice steady flow of it), your business simply dies. It's that straightforward. To stay viable, we must ensure steady cash inflow while carefully managing how it leaves our business.

Cash Does Not Lie

Making a million dollars in profit last month doesn't guarantee I have a million dollars in the bank.

Take my consulting agency, for instance. When I bill clients, most have 30-day payment terms. This means I won't see payment for today's invoice for at least a month, if I'm lucky.

Meanwhile, I've already spent money to deliver those services. I'm immediately out of pocket for expenses like meals, airfare, and hotel accommodations.

$Income - Cost = Profit$

$1,000 - 750 = 250$

Today +15 Days +30 Days Beginning Cash 5,000 4,250 2,250 Cash Flow -750 -2,000 +1,000 Ending Cash 4,250 2,250 3,250

While I’m waiting to get paid, I have ongoing operational expenses like website hosting, marketing costs, and LinkedIn Premium subscriptions. When that $1,000 payment finally arrives on day 30, I've already covered these additional costs out-of-pocket.

Without careful planning, I could easily find myself in a cash flow crunch.

Your bank account balance reveals the unvarnished truth about your business's financial health. If you don't understand the patterns of cash flowing in and out, you're setting yourself up for dangerous misconceptions.

More Cash Means More (and Better) Options

“Mo money, mo problems” is a lie.

Imagine we own a restaurant and want to expand our dining room. This expansion would allow us to serve more customers during each service period, resulting in increased revenue and improved future cash flow.

Let's say the expansion costs $10,000, and our monthly rent of $2,000 is also due.

How would our options differ with these two cash balances?

$8,000 Cash Balance $50,000 Cash Balance - We could choose not to expand and just pay rent

We could go into debt by $10K to pay for the expansion | - We could pay cash for the expansion AND pay rent

We could go into debt by $10K

We could go into debt by $3K

We could expand the dining room AND add a staff member to handle the extra volume |

With a lower bank balance, we must choose between paying for the expansion OR paying rent. Alternatively, we could borrow to cover the costs, which adds risk to our business. This pressure intensifies if the contractor exceeds the budget or experiences delays (both of which are virtually guaranteed).

With a strong cash balance, we gain flexibility. We might still finance some or all of the expansion, but if costs exceed estimates, we have cash reserves to fall back on. We even have the option to hire another server to accommodate all those new customers.

The Path Forward: Mastering Your Cash Flow

Understanding that cash is king isn't just business wisdom—it's survival intelligence. As we've explored, cash provides your business with oxygen, reveals the unvarnished truth of your financial position, and creates a landscape of possibilities rather than limitations.

In the next post, I'll share practical strategies for building a robust cash reserve that not only keeps your business secure during uncertain times but also positions you to capitalize on opportunities when they arise. We'll explore how to read a cash flow statement and how to use it to make informed decisions that prioritize long-term cash generation.

Until then, take a moment to examine your current cash position. Is it giving you the oxygen, honesty, and options your business deserves? The throne awaits a ruler who understands its true power.

See you in Part Two, where we'll turn cash flow theory into action.